Parking is often a patient’s first clinical touchpoint. When the curb feels chaotic, that tension shadows every step indoors. Deloitte found that 59 percent of healthcare consumers call convenient parking “essential,” and hospitals with standout arrivals earn profit margins up to 50 percent higher than peers.

COVID-era safety rules, rising EV counts, and climate targets now collide at the front drive. We reviewed a dozen operators and found seven that curb congestion, lift HCAHPS scores, and trim carbon while protecting revenue. Meet them below.

Key trends and challenges in hospital parking

Post-COVID safety and patient expectations

Pandemic playbooks permanently changed valet service. Visitors expect quick, low-contact handoffs and visible hygiene at every touchpoint. Today’s valet slips on fresh gloves before entering a car, wipes high-touch surfaces, and texts a paper-free claim ticket. These small rituals calm anxious families, speed the curbside queue, and guard clinical areas from outside germs.

Hospitals that reinforced these steps kept valet volumes strong during outbreaks. More importantly, they taught the public to expect the same polished routine on every visit.

Technology races ahead

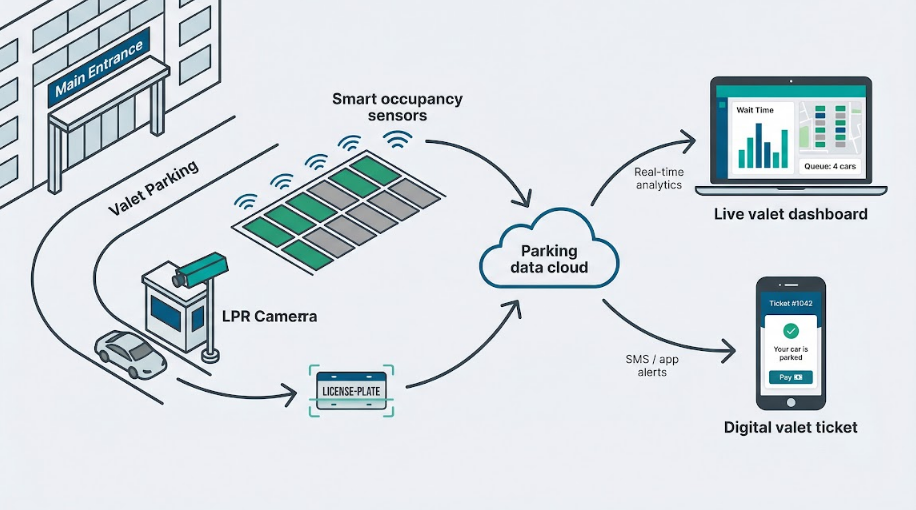

License-plate cameras now spot an arriving car before the driver rolls down a window. A text pings the owner once the vehicle is parked, and digital dashboards show facilities teams the live queue by the emergency entrance.

UrbanMatter’s 2025 valet survey notes that three-quarters of leading providers invested in smart-parking tools last year, from real-time occupancy sensors to ticket-free payment gateways. These upgrades cut wait times, curb idling, and deliver a steady stream of operational data.

For patients, the payoff is calm. No paper ticket to misplace and no worries about charger availability—the system updates quietly so they can focus on care, not parking.

Staffing and training reshape the curbside welcome

Service roles face record turnover, and valet crews feel the pressure. The best providers raised the bar rather than cut corners.

Today’s valet is part driver, part concierge, and part mobility aide. Companies cross-train employees to escort patients with wheelchairs, guide worried families through sprawling campuses, and jump into shuttle duty during shift changes. That versatility keeps lines moving even when schedules tighten.

It also lifts satisfaction. When one uniformed team handles every hand-off from car door to reception desk, patients feel guided instead of shuffled. Hospitals win twice: fewer vendors to manage, and a front-door staff fluent in both hospitality and clinical etiquette.

Sustainability and ESG goals steer investment

Hospital climate pledges now put the parking lot under the microscope. Endless loops of idling vehicles waste fuel and inflate carbon reports, while drivers hunt for wall plugs like rare birds.

Leading valet partners solve both issues at once. They guide cars straight to open bays, reducing needless laps, and reserve prime spots for electric vehicles connected to smart chargers. UrbanMatter’s survey counts fifty thousand new chargers coming online in top networks, proof that green mobility is now standard, not a fringe perk.

The detail matters too. When a patient arrives at a curb lined with electric shuttle carts and paperless ticket kiosks, the hospital’s sustainability promise feels tangible. It means lower Scope 1 emissions for the facility, cleaner air for the community, and reassurance that you care about every detail of their health—including the air they breathe on arrival.

How we selected the top 7 providers

You deserve a list built on data, not guesswork. We began by mapping a dozen companies that frequently appear in hospital RFPs or industry rankings. UrbanMatter’s 2025 survey of major valet operators provided a market snapshot, then we added insights from case studies and client interviews.

Next, we scored each contender on six factors that matter at the front door: patient experience, technology, cost efficiency, sustainability, scale, and a unique differentiator such as Joint Commission certification. We weighted those factors at 25, 20, 15, 15, 15, and 10 percent, mirroring what hospital leaders say they value when contracts renew.

The math made the choice clear. The seven providers you will meet next deliver warm curbside care, measurable ROI, and a proven path to greener operations. They satisfy every item on a modern hospital’s valuation checklist.

1. FC Parking (FC Valet): boutique hospitality with high-tech speed

FC Parking promises to treat every arrival like a VIP check-in and backs that warmth with real-time technology.

The team focuses on healthcare, serving more than 150 hospital and clinic locations across Illinois and Florida. That tight focus shows in curbside choreography. Valets greet drivers, assist passengers with mobility needs, and park each car in about sixty seconds, a metric hospital CEOs watch on dashboards.

Speed is only part of the story. A proprietary valet app texts patients when their vehicle is ready and streams live wait-time data to managers. These insights help set staffing hour by hour, cut overtime, and keep lines short even on busy clinic days.

Service delivers savings. At one Advocate Health facility, FC Parking reduced the annual parking budget by 27 percent while lifting patient satisfaction, according to the company’s 2024 case study. Fewer staff hours lost to guesswork and smarter routing that trims shuttle mileage make the math work.

Sustainability matters too. FC Parking enforces no-idle rules and increasingly uses electric low-speed shuttles for remote lots, lowering exhaust and noise outside the emergency entrance.

Bottom line: if you want national-grade tech wrapped in boutique hospitality, FC Parking deserves your first conversation.

The company’s 2024 rollout report shows hospitals that combined 60-second drop-offs with text-ticket retrieval cut no-show appointments by roughly ten percent while trimming average curbside wait by three minutes.

For the full tactic breakdown, FC shares a practical guide on healthcare parking management you can adapt to your own campus.

2. Towne Park (Towne Health): nationwide scale, hotel-grade warmth

Towne Park earned its reputation serving luxury hotels, then carried that five-star polish to more than 800 healthcare sites across the country. The curb now feels like a grand-hotel welcome paired with clinical precision.

Patients step out to gloves-on, smile-forward attendants trained in Safe 360 safety protocols. Steering wheels receive a quick disinfect, keys move into digital lockers, and families head inside without the usual parking shuffle. Hospitals appreciate the consistency; whether the facility is in Miami or Minneapolis, the playbook stays the same.

Technology matches the hospitality. After buying a smart-parking sensor firm in 2025, Towne Park began offering real-time occupancy maps and ticket-free exits. Visitors enjoy faster retrievals, while administrators gain detailed data on curbside bottlenecks, staffing needs, and emissions saved when engines spend less time idling.

Cost control comes from breadth. Large systems often combine valet, garage management, and patient transport into a single Towne Park contract, reducing vendor sprawl and capturing volume discounts.

If you manage a multi-campus network and want identical, high-touch service everywhere, Towne Park has the bench strength and the tech stack to deliver.

3. LAZ Parking: tech-savvy green giant

LAZ manages more than five thousand sites across forty-four states and Canada. Scale alone is impressive, yet the real story is how quickly the company steers that size toward new technology and sustainability.

In early 2025 LAZ signed a deal to install fifty thousand Level-2 chargers across its network. For hospitals that means instant EV capacity without hunting for grants or juggling vendors. Visitors plug in while valets track charging status on the same dashboard that shows bay availability and average wait times.

Service remains personal despite the footprint. LAZ trains every attendant in “The LAZ Way”: greet, own the guest’s need, close the loop. That culture shows when a valet escorts an unsteady patient to admitting or brings a wheelchair before anyone asks.

Cost efficiency follows reach and data. LAZ can spread tools such as license-plate cameras, mobile pay, and AI analytics across thousands of lanes, then return the savings through revenue-share or flat-fee models that often undercut regional bids.

If your hospital wants infrastructure that grows with EV demand and a curbside team already fluent in app alerts, LAZ is a strong candidate.

4. SP+ (SP Plus Corporation): AI-powered efficiency

SP+ has parked cars for decades, and its newest edge comes from silicon. After partnering with computer-vision firm Metropolis in 2024, the company rolled out Sphere, a camera network that reads license plates on entry and releases cars without a ticket or gate on exit.

For patients, the process feels seamless. They roll through, hand over keys, and later drive away without digging for validation slips. Your hospital gains measurable wins: fewer attendants tied to payment booths, shorter queues, and a live feed of occupancy data that guides staffing and security.

SP+ matches the tech with hospitality basics. Attendants still open doors, find wheelchairs, and escort anxious families inside, yet the culture leans on process engineering. Think standard procedures, weekly dashboard metrics, and continuous-improvement audits shared with facilities teams.

The footprint spans more than four thousand sites, letting multi-state health systems rely on one contract for consistent service. Add AI that trims exit idle time and the decision is clear: if you want smooth flow backed by data, SP+ fits the brief.

5. Propark Mobility: mid-size operator with a green streak

Propark pairs start-up agility with four decades of parking experience. The company manages about seven hundred fifty sites, large enough to secure buying power yet small enough to shape each contract to local needs.

Fresh thinking drives the roadmap. Propark pilots tools such as mobile pay, occupancy sensors, and dynamic pricing at select hospitals, then scales the winners quickly. This pilot-and-scale approach lets your facility access new features without shouldering development costs or waiting for big-company rollouts.

Sustainability runs just as deep. Propark helped draft early Green Garage standards and now includes LED lighting, EV charging, and guidance systems in most bids. Where these tools launched, visitor drive-around time dropped and energy use fell in the same quarter.

On the service side, valets double as wayfinders. They escort anxious patients inside, radio ahead so front-desk staff can prepare wheelchairs or translation help, and keep the curb moving.

Choose Propark when you want bold ideas, eco-forward design, and a partner willing to adapt the playbook to your campus rather than reuse a national template.

Finally honorable mentions include Health Park valet and HHS, which we didn’t have room to cover in this article but we do include them in the side-by-side comparison below.

Side-by-side comparison at a glance

Numbers often reveal what prose can only hint at. The table below distills the seven providers into five quick-scan factors so you can match strengths to your hospital’s wish list in seconds.

| Provider | Size / reach | Stand-out tech | Sustainability edge | Typical cost model | Best for |

| FC Parking | 150 + sites, Midwest & Florida | Proprietary valet app with live wait-time feed | Electric shuttle carts, strict no-idle policy | Hospital-funded program that delivered a 27 percent budget drop at one site | Facilities wanting boutique care and clear ROI |

| Towne Park | 800 + sites nationwide | Smart-sensor occupancy maps, ticket-free exit | Data-driven traffic plans cut idle emissions | Bundled valet + garage + transport under one volume contract | Multi-campus systems seeking uniform service |

| LAZ Parking | 5,300 locations in 44 states & Canada | Mobile pay plus LPR tied to 50 k EV chargers | Largest EV-charger rollout in the sector | Revenue-share or flat fee, often beats regional bids | Hospitals prioritizing future-ready, green infrastructure |

| SP+ | 4,200 facilities | Sphere AI computer-vision gates | Gateless design trims exit queue emissions | Efficiency-based management fee | Sites needing data-rich, smooth flow |

| Propark Mobility | 750 locations | Rapid pilot cycles for new apps and sensors | LED, EV, and Parksmart consulting built in | Custom fee or shared-savings model | Hospitals that want agile progress and eco gains |

| HealthPark Valet | Regional, 25-year healthcare specialist | Industry-standard SMS alerts | Valet-lobby integration reduces patient laps | Free-to-user or low flat fee with tips | Mid-size hospitals valuing compassion over scale |

| HHS | Hundreds of hospitals across multiple services | Unified arrival notes to inside transport teams | Paperless tickets and idle-reduction training | Bundled with housekeeping, transport, concierge | Administrators seeking one accountable partner |

Conclusion

Use the grid as a filter: focus on the column that matters most to your C-suite, then see which providers remain in play.